See How Groupe BPCE Uses Skylight to Drastically Reduce Their Resolution Time

Financial Services

Get your copy of “Optimizing Network & Application Performance For Financial Services Organizations”

Get your copy of the Solution Brief

According to PwC’s global CEO survey, 81% of banking CEOs are concerned about the speed of technology change, more than any other sector

For banking, financial services, and insurance companies around the world, being technologically-focused, agile, and seamlessly connected with customers and partners is not just a strategic mission, but a critical imperative. This sector is undergoing significant transformation at an accelerated rate of technological change driven by the:

- Rise of empowered, mobile consumers and expectations for a seamless omnichannel experience

- Emergence of cybercurrencies, blockchain, non-traditional competitors, and value chains

- Acceleration and growing market share of FinTech and other technology providers

- Constant onslaught of cyberthreats and attacks on profitability and performance

The technological disruption taking place means that speed and accuracy in collecting and analyzing data from a broad range of devices, multi-cloud environments, and disparate systems can mean all the difference between significant profit and catastrophic loss.

of banking and payment companies will be at risk from technological disruption by 2020, while one in five insurance, wealth management, and asset management firms will be at risk

Why Skylight?

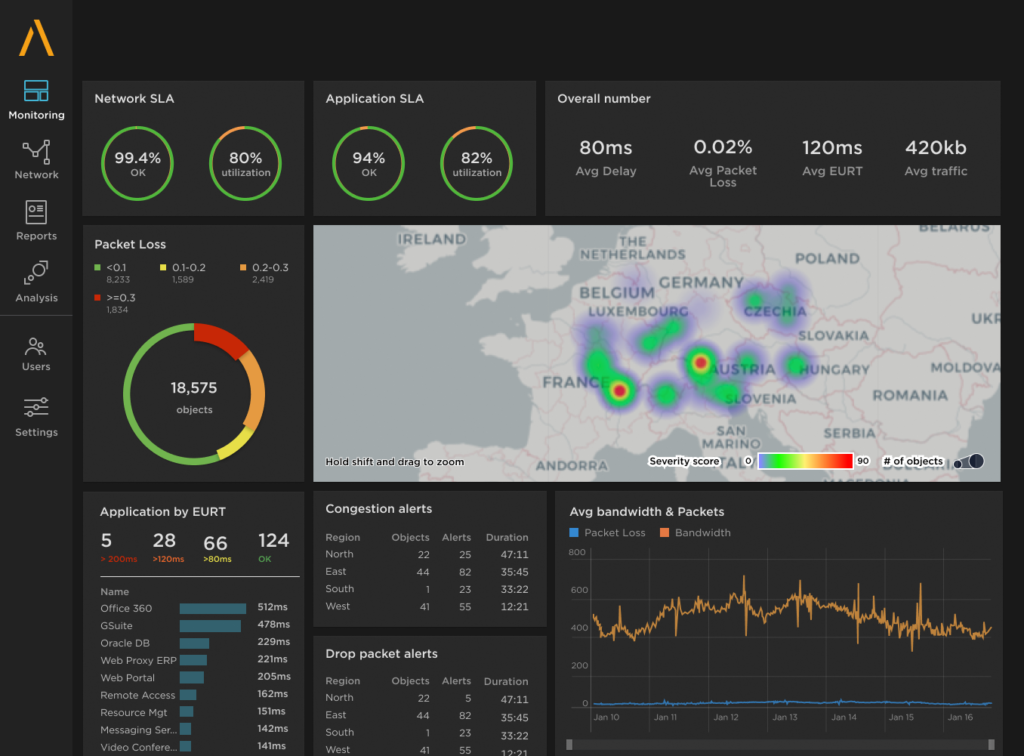

Drive performance with combined active & passive monitoring

Skylight’s single pane of glass gives you full control of end user experience

Lower costs with powerful metadata

Skylight’s compact, structured metadata saves on storage and provides high definition visibility into every transaction

Put an end to finger pointing

Speed up problem solving and quickly identify what’s causing service degradation with the fastest resolution times (MTTR)

Detect the hidden cause of slowdowns

Skylight detects the invisible microbursts that are slowing down your network with exceptional granularity

“We clearly have shorter resolution times with Skylight. We get clear facts and answers instantly…and it helps our network and security teams improve our infrastructure.”

Jeremy Renard, Network Engineer, Groupe BPCEGroupe BPCE dramatically reduces resolution times with Skylight

Read their storyApplication slowdowns and downtime are not an option

Moving applications to the cloud and deploying agile, high-performance networks are a key part of digital transformation for the financial services industry. Financial institutions need to be focused on cutting-edge technology and agile in adopting new solutions in order to stay ahead of the competition and deliver flawless experiences for customers and partners.

Performance degradation is unacceptable and even minor packet-loss, minimal delay and almost imperceptible microbursts can impact customers and end users significantly.

Downtime is unimaginable.

A low total cost of ownership with compact, structured metadata

Skylight can instrument all of the enterprise WAN circuits, including SD-WAN, and build in activation testing, microburst metering, remote packet capture, and more at a low TCO. Skylight offers an efficient metadata approach for Layer 2 to 7 active and passive monitoring which can save you 300-900% on storage and bandwidth costs.

Remote branches need to run at peak performance

Skylight actively monitors application performance end-to-end across your network, from HQ to remote branches. It detects microbursts, delay, and packet loss that impacts your end user productivity and customer experience.

Skylight also monitors actual network traffic, application transaction times, and client server delays. The complete view of network and application performance across the full stack lets you pinpoint issues that are impacting your end users.

High definition visibility, from the data center to the edge

Many banks still rely on dated and disjointed tools and processes for monitoring, testing and maintaining business-critical networks and applications. Skylight analytics together with telemetry and machine learning correlate performance data in near real time to quickly pinpoint and troubleshoot issues and use predictive analytics to prevent faults.

Improved delivery, better visibility: How Accedian and VMware are working together to help CSPs navigate the 5G world

Improved delivery, better visibility: How Accedian and VMware are working together to help CSPs navigate the 5G world

Adding a new dimension of visibility to the Cisco Full-Stack Observability portfolio with Accedian Skylight

Adding a new dimension of visibility to the Cisco Full-Stack Observability portfolio with Accedian Skylight